Personal Checking Accounts

The right checking account puts you in control

Free

Make life easy with our simplest personal checking account.

Premier

Get the upgrade with the personal checking account that pays you interest.

Prestige

Sign up for the VIP experience—an interest-bearing personal checking account with the best features.

Answer a few questions to find the right checking account

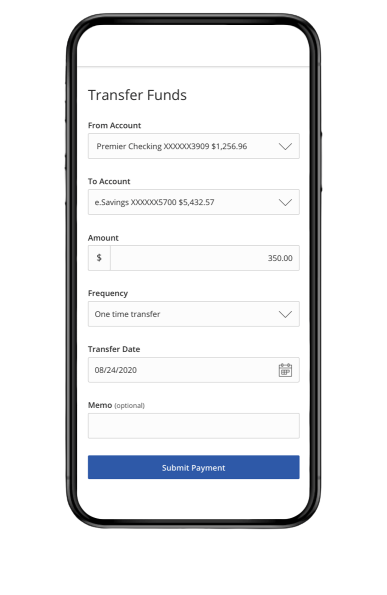

Instantly move your money wherever you need it

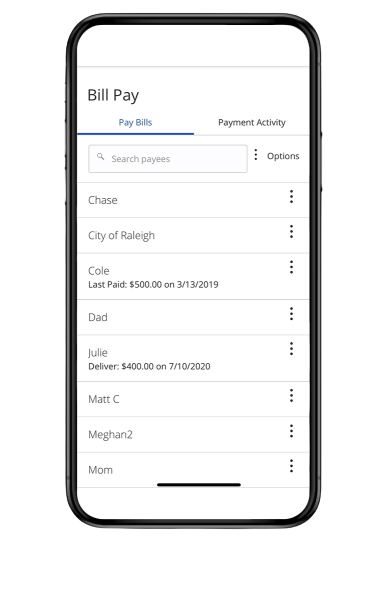

Pay your bills from any device

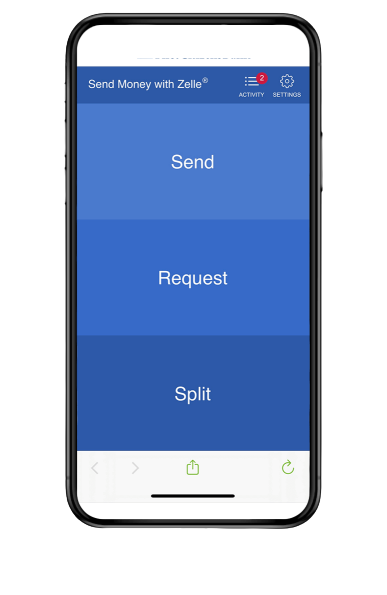

Send money with Zelle®

Transfer funds to other accounts

Explore proactive protection tools that can help you track and manage your moneyD

The same secure banking you've come to rely on us for in person, online

Security Alerts

We'll automatically send you alerts if your account credentials change.

Card Freezes

Temporarily freeze or unfreeze your card if it's lost or stolen, or if you suspect fraud.

Advanced Security

Rest assured that all your confidential account information is protected.

Insured

Your money is insured by the Federal Deposit Insurance Corporation.