Online Savings Account

A simple, convenient online savings account

Easy to open and save on the go

You can count on convenience when you open a Ed National Bank online savings account. Track your balance and deposit checks anytime, anywhere.

No minimum balance

Save as much or as little as you're ready for.

No monthly service charge

You won't pay a fee to keep your online savings account open.

Competitive rates

Earn interest on your daily balance and receive monthly credits.

Easy access and low fees

Open with less

Open your online savings account with a low minimum opening deposit of $50.

Earn interest

Earn 0.03% APYDD on your daily balance, compounded daily and credited monthly.

Easily access your money

Your first two withdrawals or transfers per month are free, then $3 each.

Get overdraft protection

Choose the right level of overdraft protection coverage for your account.

Bank when you want

Enjoy free digital banking, bill pay and 24/7 mobile deposits.

Get alerts

Securely keep track of your account activity with text and email alerts.

Spot spending trends

Use the Manage My Money trends tool to visualize your spending habits.

How to get started

It's easy to open a savings account online in just 3 steps.

Tell us about yourself

To start your application, we'll ask for your personal details such as name, address, email address and Social Security number.

Make your first deposit

Make an initial deposit of $50 or more with your credit or debit card, or by transferring funds from an existing Ed National Bank checking or savings account.

Enroll in Digital Banking

Get access to your online savings account right away when you enroll in Digital Banking.

Instantly move your money wherever you need it

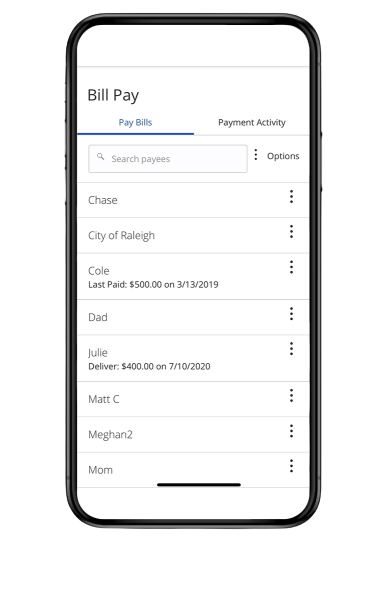

Pay your bills from any device

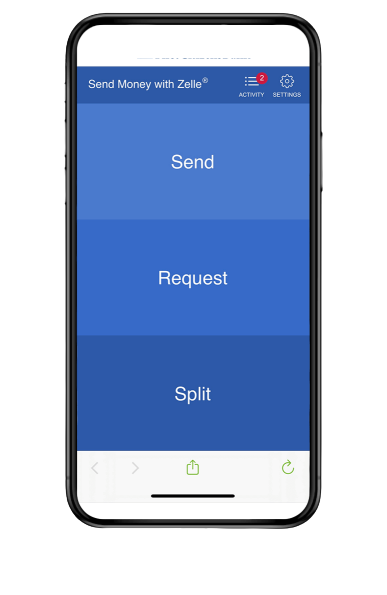

Send money with Zelle®

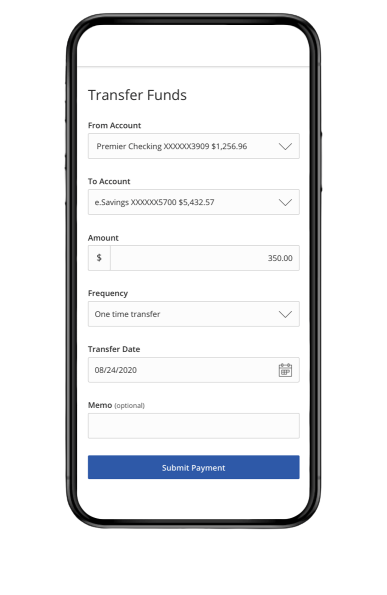

Transfer funds to other accounts