Small Business Savings Accounts

Put your extra cash flow to work

Watch your savings grow

Choose from three small business savings accounts to help support your business needs with earned interest and convenient online access.

Business Savings

Get the benefits of savings with liquidity and a stable source of interest-bearing funds.

Premium Money Market Savings

Help maximize your liquid savings—the higher your balance, the greater your interest.

Business CDs

Earn a guaranteed fixed interest rate.

Ready to get started?

Manage your business on the go

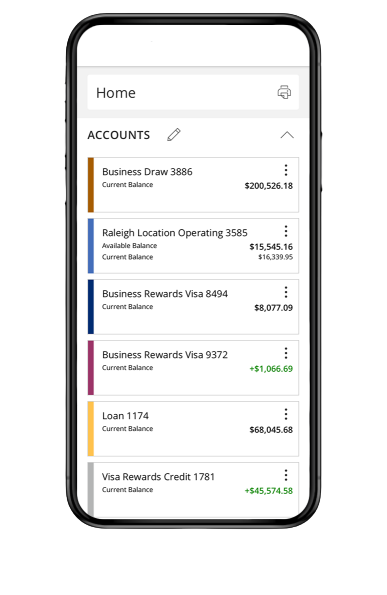

Manage your accounts from anywhere

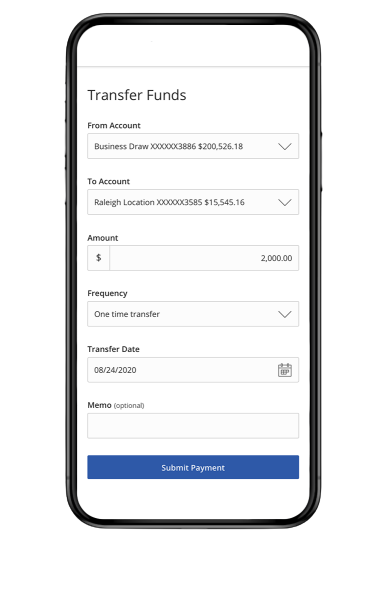

Send and transfer money using ACH and wires

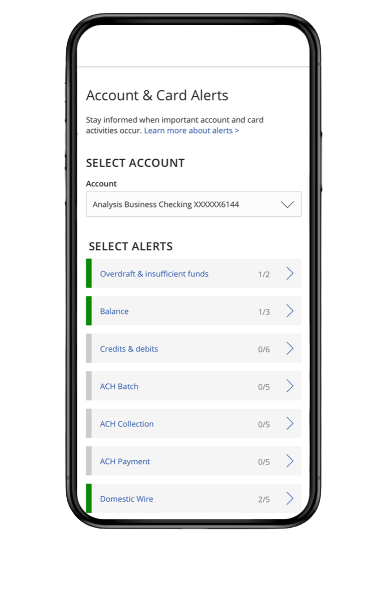

Receive account and security alerts