Private Banking

Traditional banking specialized for you

Your lifestyle, needs and ambitions often demand a one-of-a-kind financial strategy. Traditional banking can miss the mark, but our dedicated Private Bankers can help customize a banking package with flexible terms and enhanced benefits to help manage your financial life at the level you deserve. Our private banking services include a range of specialized deposit and lending products as well as an extended team to help plan for all financial aspects of your life.

Deposits

Your Private Banker helps ensure you have the right types of bank accounts to manage your financial life effectively. We offer enhanced benefits, including:

- Checking and savings accountsD

- Higher purchase and ATM withdrawal limits

- Unlimited use of non-Ed National Bank ATMsD

- Free specialty designed checks, traveler's checks, cashier's checksD and money orders

- Foreign currency service

- Online account management options

We also offer an Asset Management AccountD that combines the features of a brokerage account with a checking account. This account simplifies the way you invest and gives greater flexibility to manage finances through one consolidated account. An Asset Management Account provides the same benefits of a traditional checking account to write checks, pay bills and make purchases in addition to a variety of money market options so your money is always working.

Lending

We can help you borrow smarter and better and understand the credit optionsD available. We’ll work with you to choose an effective approach to planning and borrowing. Our concierge-level service includes:

- A dedicated Private Mortgage Banker

- Tailored pricing on loans, lines-of-credit, business services and more

- Streamlined underwriting processes

Full-Service Team

But we don’t stop there. Your Private Banker partners with a multidisciplinary wealth management teamD empowered with a wide range of other product and service offerings, including:

- Financing Wellness Planning: Helping do more with the money you earn, save and invest.

- Retirement Planning: Creating a strategy to enable you to live the life you’ve worked hard to achieve.

- Estate Planning: Helping provide for your family, business and charitable commitments.

- Trust Administration: Together, we make sure assets keep working as hard as you have.

Get to know your new Private Banker

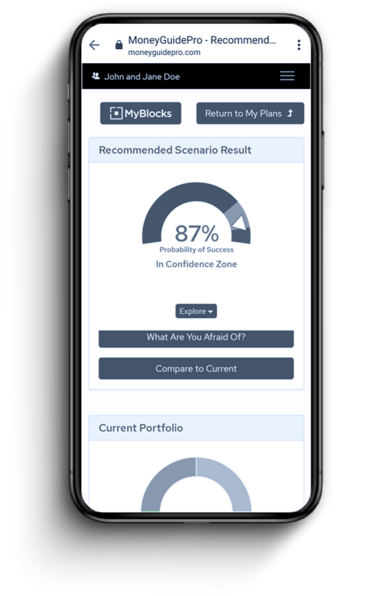

View your financial plan at a glance

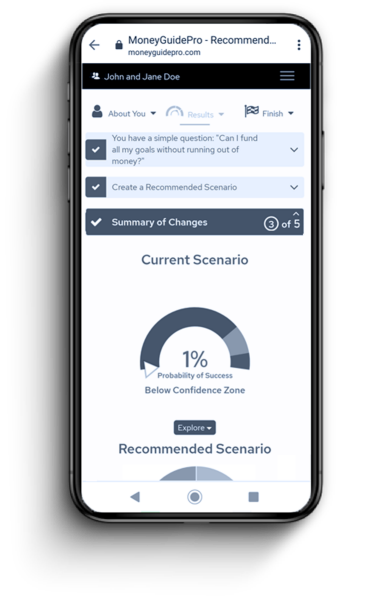

Adjust goals to see different scenario outcomes

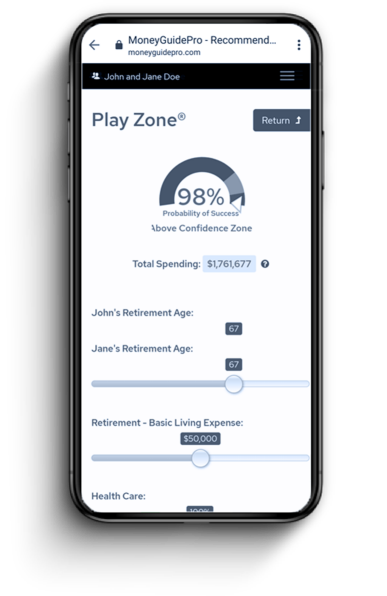

Collaborate with your financial partner