Compare Business Checking Accounts

Find features that fit your business

Compare

Here's a quick glance at our business checking accounts to help you decide.

|

|

||||

|---|---|---|---|---|

Features |

Essential checking |

Moderate activity |

Moderate activity |

Frequent activity |

Discounted Treasury Management services |

0 |

1 |

2 |

3 |

Monthly fee |

$0 when enrolled in paperless statementsD |

$0 if requirementsDD are met; otherwise, $25 |

$0 if requirementsDD are met; otherwise, $50 |

$0 if requirementsDD are met; otherwise, $75 |

Minimum opening deposit |

$100 |

$100 |

$100 |

$100 |

Monthly fee includes |

100 itemsD |

250 itemsDD |

500 itemsDD |

750 itemsDD |

Out-of-network ATM fee |

$2.50 |

$2.50 |

$2.50 |

$2.50 |

Check Recovery Service |

icon: sys-checkmark |

icon: sys-checkmark |

icon: sys-checkmark |

icon: sys-checkmark |

We're here to help you decide which account is best for you.

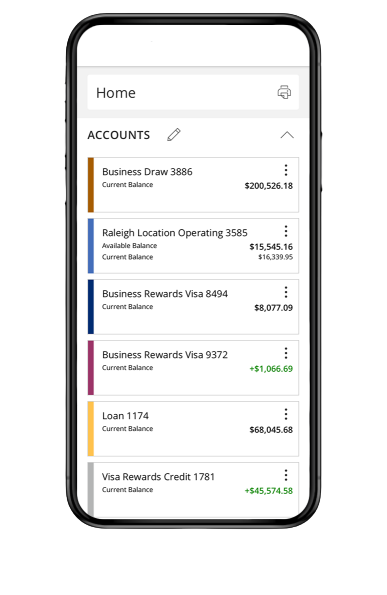

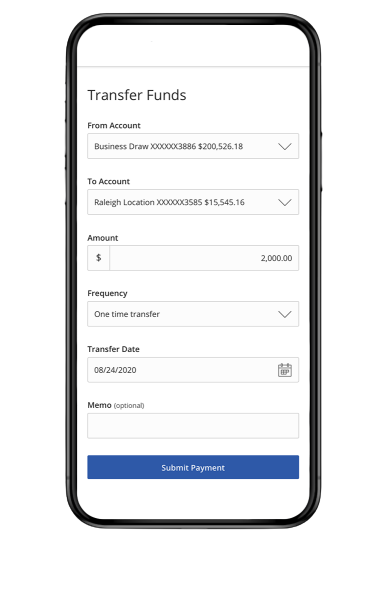

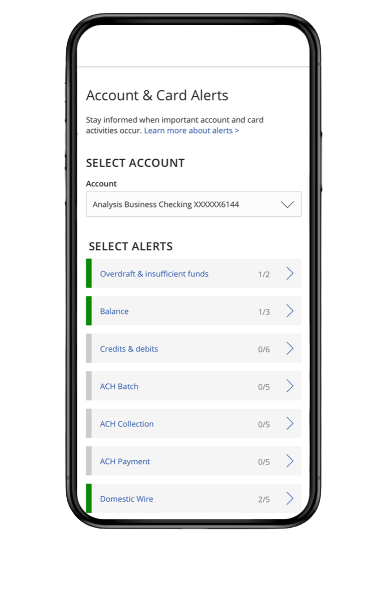

Manage your business on the go

Manage your accounts from anywhere

Send and transfer money using ACH and wires

Receive account and security alerts