CORE Business Checking

Small business checking with full service

Charitable Checking

Ideal for small community organizations, religious and estate accounts.D

No Minimum Balance

Never worry about maintaining a balance.

No Monthly Fees

Enroll in paperless statements to avoid the monthly fee.D

Everything included

A nonprofit, charitable businessD checking account with no minimum balance and no maintenance fees.

Convenience without costs

Online and mobile access

Access to Digital Banking Solutions for your business—from anywhere.

Earn interest

Earn interest on daily collected balance.D

More options

Unlimited use of any Ed National Bank ATM or branch in our network—for free.D

Manage your business on the go

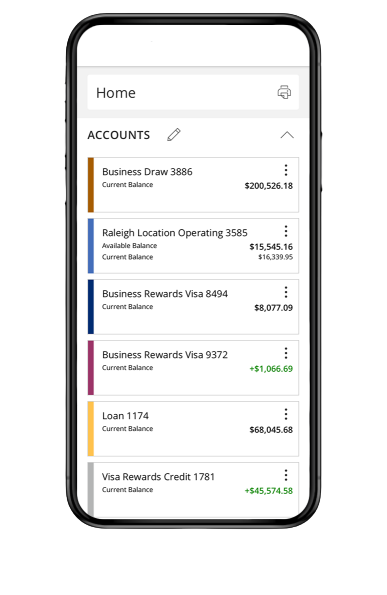

Manage your accounts from anywhere

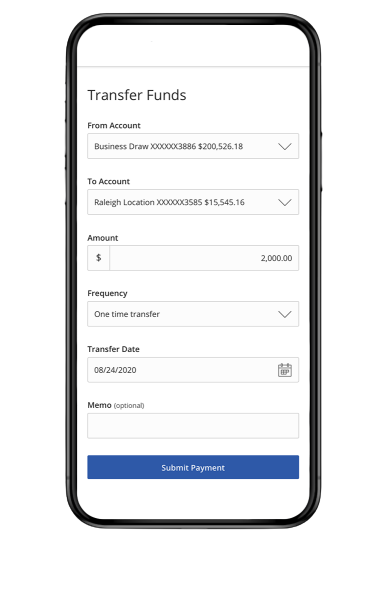

Send and transfer money using ACH and wires

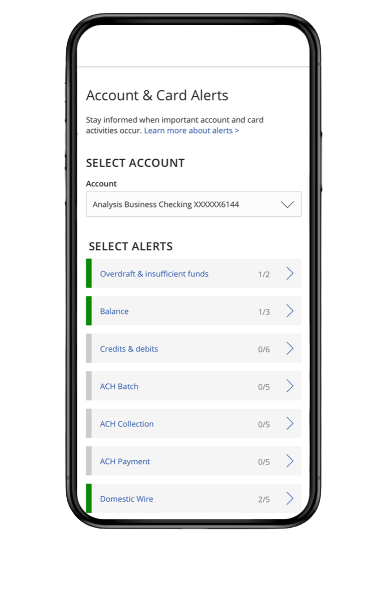

Receive account and security alerts